Global X Uranium UCITS ETF USD Acc | URNURegistrer dig for at låse op for ratings |

| Fondens performance | 28-02-2025 |

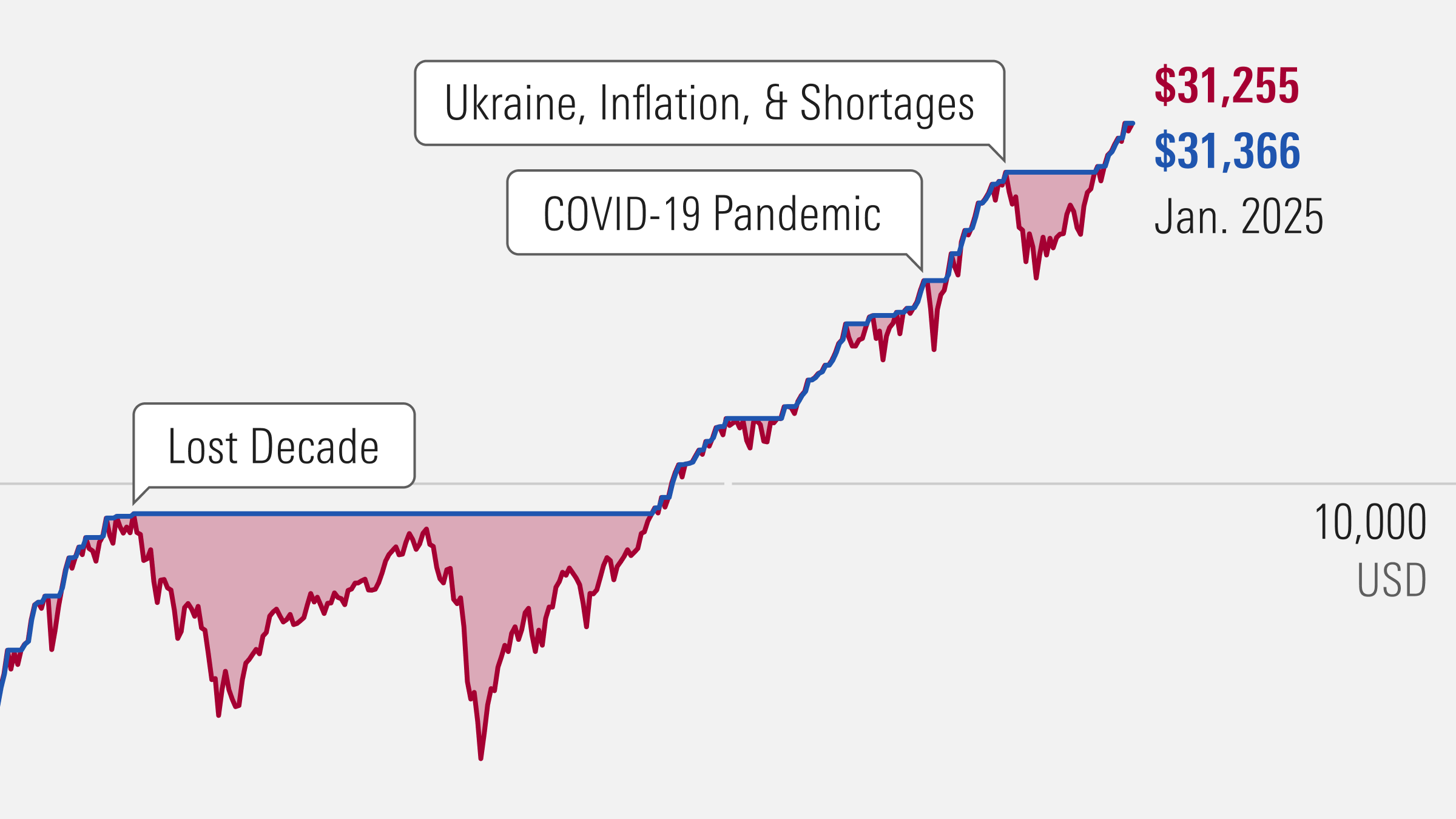

| Vækst af 1.000 (DKK) | Avanceret graf |

| Fond | - | - | 35,5 | 8,0 | -7,5 | |

| +/-Kat | - | - | 36,5 | 7,5 | -9,2 | |

| +/-Indeks | - | - | 39,9 | 10,3 | -11,0 | |

| Kategori: Sektor - Naturressourcer, Aktier | ||||||

| Kategoribenchmark: Morningstar Gbl Upstm Nat R... | ||||||

| Oversigt | ||

| Closing Price 28-03-2025 | USD 13,20 | |

| Kursændring 1 dag | -2,86% | |

| Morningstar Kategori™ | Sektor - Naturressourcer, Aktier | |

| Omsætning | 36381 | |

| Børs | LONDON STOCK EXCHANGE, THE | |

| ISIN | IE000NDWFGA5 | |

| Markedsværdi i alt (mio.) 08-09-2022 | USD 21,49 | |

| Seneste TNA(mio.) 28-03-2025 | USD 173,08 | |

| Løbende omkostning 31-12-2024 | 0,70% | |

| Investeringsstrategi | Passiv | |

| Investeringsmålsætning: Global X Uranium UCITS ETF USD Acc | URNU |

| The investment objective of the Fund is to provide investment results that closely correspond, before fees and expenses, generally to the price and yield performance of the Solactive Global Uranium & Nuclear Components Total Return v2 Index (the “Index”). |

| Returns | |||||||||||||

|

| Management | ||

Manager navn Startdato | ||

- - | ||

Startdato 22-04-2022 | ||

| Annonce |

| Kategoribenchmark | |

| Fondens indeks | Morningstar indeks |

| Solactive Gbl Uranium&Nclr Cmpnts v2 USD | Morningstar Gbl Upstm Nat Res NR USD |

| Target Market | ||||||||||||||||||||

| ||||||||||||||||||||

| Formuefordeling Global X Uranium UCITS ETF USD Acc | URNU | 27-03-2025 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Top 5 placeringer | Sektor | % |

Cameco Corp Cameco Corp |  Olie og gas Olie og gas | 14,98 |

NexGen Energy Ltd NexGen Energy Ltd |  Olie og gas Olie og gas | 7,27 |

National Atomic Co Kazatomprom J... National Atomic Co Kazatomprom J...

|  Olie og gas Olie og gas | 6,30 |

Uranium Energy Corp Uranium Energy Corp |  Olie og gas Olie og gas | 6,16 |

Oklo Inc Class A Shares Oklo Inc Class A Shares |  Forsyning Forsyning | 4,82 |

Øget Øget  Mindsket Mindsket  Ny siden sidste portefølje Ny siden sidste portefølje | ||

| Global X Uranium UCITS ETF USD Acc | URNU | ||